These partnerships will allow Svamaan to offer a digital and safe loan disbursements, as well as collections experience while adhering to social distancing and safety norms in business operations.

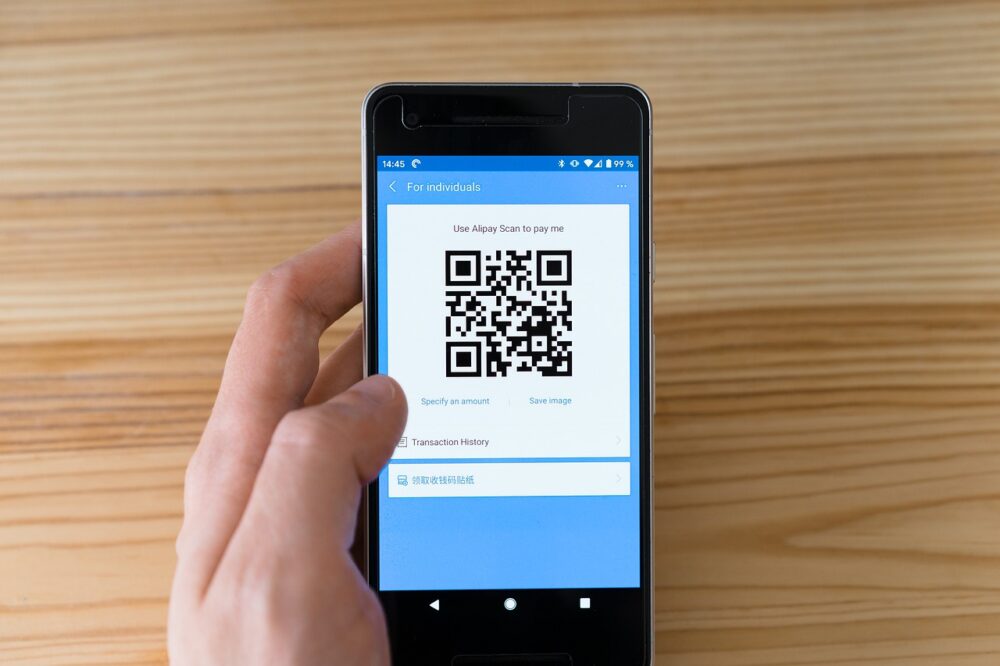

Svamaan Financial Services, a leading digital microfinance venture, has rolled out QR code based UPI payment option for all its customers through leading digital payment apps like GooglePay, PhonePe and PayTM, in addition to all banking apps offering QR code based UPI payment facility.

Svamaan Financial has established partnership with prominent digital payment companies including PayU, FINO Payments Bank and PayNearby for providing a cashless and contactless experience to all its customers in view of the Covid19 pandemic. These partnerships will allow Svamaan to offer a truly digital and safe loan disbursements as well as collections experience for all its customers while adhering to social distancing and safety norms in business operations.

According to Mrs. Anushree Jindal, Founder & Director of Svamaan Financial Services, “Svamaan’s primary goal has always been to empower rural women and make them financially independent. Covid19 pandemic has particularly affected the low-income groups across the country in terms of lack of easy availability of finance. In times like these, Svamaan is committed to provide a much-needed helping hand to rural women to rebuild their dreams. Through our partnerships with PayU, FINO, PayNearBy and our QR code based UPI payments, we are extending benefits of the cashless economy & digital payments to Indian villages and all our rural women customers in line with our goal towards driving financial inclusion and a truly digital India”

Mr. Maneesh Goel, CFO, PayU payments said, “Within a short period of time Svamaan has seen excellent growth in MFI lending. We are pleased to work with Svamaan in their digitisation journey and extend financial inclusion to customers from the rural heartland. This partnership is also aligned with our vision of working with strategic allies to develop a full-fintech ecosystem to provide digital financial services”

Mr Anand Kumar Bajaj, MD & CEO of PayNearby said, “We are delighted to partner with Svamaan Financial and drive the agenda of true financial inclusion together. Their consumer-centric digital approach is strongly aligned with our vision of leaving no segment behind in our ‘Zidd’ for financial empowerment. PayNearby’s deeply entrenched network of trusted Digital Pradhans has been instrumental in aiding seamless cash collection in this digital era for communities that are still dependent on cash. The partnership will give customers adequate flexibility and a hassle-free way to deposit cash at their nearest retail touchpoint. Our association with Svamaan will help meet the evolving needs of unbanked and underbanked customers and give rise to a generation unencumbered by the lack of access to traditional financial services.”

Svamaan has already rolled out the QR code based UPI payment options and has activated kiosk-based cash deposit facility for all its customers in partnership with Fino Payments Bank and PayNearby. Svamaan will work with PayU, India’s leading online payments solution provider, for onboarding on the Bharat Bill Pay System (BBPS) as a biller in the NBFC category and for setting up its eNach & UPI Auto-debit facility for all its customers through API integration.

Localized lockdowns implemented across India as a response to current Covid pandemic has severely impacted collections across the sector, as customers were not accessible during lockdowns. According to CRISIL, collections of microfinance institutions plunged to near zero levels in April because of the nationwide lockdown to stem the COVID-19 pandemic, but had rebounded to 70-75 per cent in July as restrictions were relaxed. Microfinance companies are now looking at digital payment options to ensure diversified and safe repayment options for all its customers.

According to Mr Kiran Kumar, CEO of Svamaan Financial Services, “Covid19 pandemic has accelerated the digital transformation of the microfinance sector from 3-5 years to 6 months. Demonetization had provided an opportunity for the sector towards being completely cashless in loan disbursements with collections continuing to be in cash. At Svamaan, following a digital first approach, we are happy to transition towards cashless mode of operations from inception allowing for a faster transformation of the sector towards achieving the goals of financial inclusion and a truly digital India.”